Revex is helping address domestic processing of critical minerals by

Reshoring processing and refining to the US instead of relying on foreign smelters

Reclaiming minerals and creating new byproducts from mine tailings (waste)

Recovering critical minerals from spent Li-ion batteries

Meeting or exceeding all environmental and safety requirements from our facilities

Securing resilient critical mineral supply chains is essential to our national security, economic security, and technological leadership.

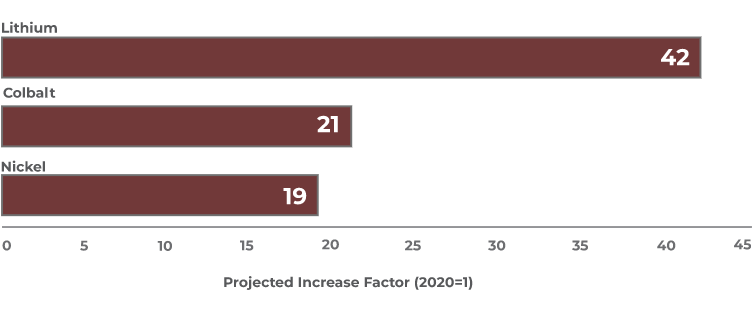

Demand is outpacing supply

Growth in demand for selected minerals from clean energy technologies, 2040 relative to 2020

What makes a metal "critical"?

It serves an essential function in one or more energy technologies and has a significant risk of supply chain disruption.

Nickel, cobalt, and lithium are high on the critical mineral list and essential building blocks for a clean economy, the defense and space industries; they are used in wind turbines and solar panels, EV batteries and motors, renewable energy transmission, and more.

Critical materials for high-capacity lithium-ion batteries – particularly Class I nickel, lithium, and cobalt – [are] primary upstream supply chain vulnerabilities.

The Result

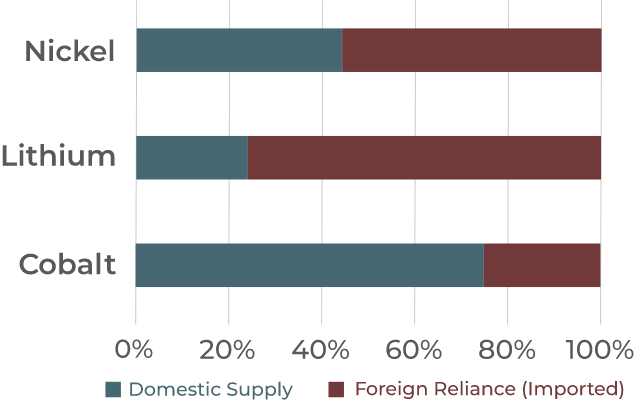

The US is reliant on foreign import from our domestic supply of nickel (56%), cobalt (76%), and lithium (25%)

The US has critical mineral reserves and exploration to identify new reserves

The US has small identified nickel reserves (110,000 tonnes), substantial lithium reserves (630,000 tonnes), and the 10th highest global cobalt reserves (55,000 tonnes)

There is limited domestic mining

The US has one nickel mine (Michigan), one lithium mine (Nevada), and no cobalt mines

There is minimal processing capability

The US has no nickel or cobalt refineries and limited lithium processing capability

Where the US obtains critical minerals is important

Currently, 47% of US nickel imports are from non-FTA* countries, including 11% from Russia. This is expected to increase to 92% of imports coming from non-FTA countries by 2035 if nothing changes. Indonesia, the largest nickel extractor and non-FTA country, has substantial mining and processing investment ownership by the Chinese.

FTA = Free-Trade-Agreement

Nickel, in particular is a security concern

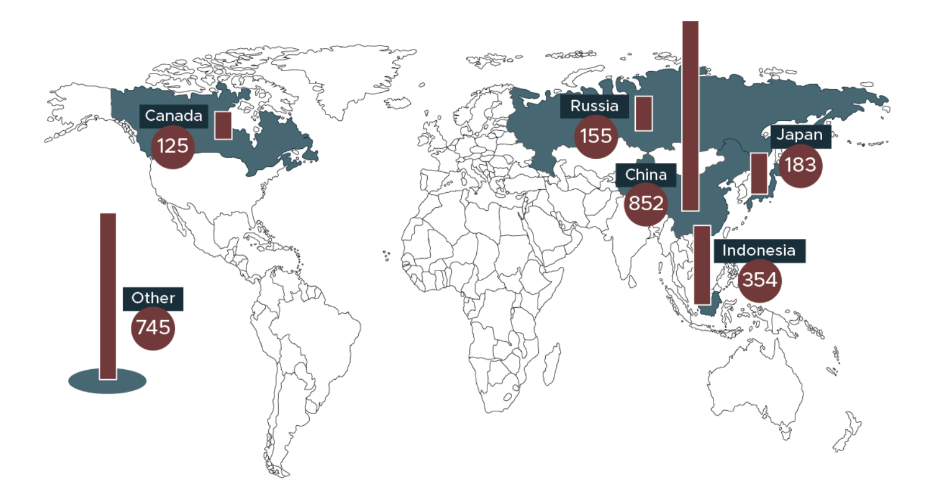

The US has only one operating nickel mine, Eagle Mine (Lundin Mining). Global Distribution of Nickel Mining (above).

A Global Effort

A Global Investment of over $100B into Critical Mineral Processing over the Next Decade

The IEA estimates global investment in critical mineral processing will need to reach $90–210 billion over 2022–2030 to enable net zero energy transition, and more than 380 new mines will be required to meet battery demand by 2035.

Solutions Highlighted by the US White House Administration

& How Revex is a Part of the Solution

Reshoring & Expanding Domestic Mineral Processing

Mining expansion alone won’t solve the US challenge to become competitive with China on critical minerals during the energy transition. Instead, energy experts agree “the key problem the current administration must swiftly address is the dearth of US mineral processing plants and refineries.” Even if more minerals are mined in the US, the vast majority will have to be shipped abroad for smelting and then imported.

Revex will redirect some North American mineral ore concentrate from overseas smelters to its domestic processing facility. Revex provides a better, more environmentally-friendly alternative.

Support Nickel & Cobalt Recovery from Unconventional Sources

Reclamation of Mining Waste

Standard processing of mine rock in both nickel and cobalt mines leave behind minerals that cannot be recovered from current mine ore processing techniques. Reclaiming and processing this remaining mineral content is a designated priority for the current White House Administration and the Department of Energy.

Mine tailings waste resulting from many mining processes can be acid-generating and challenging to dispose of appropriately. The disposal of mine tailings is a hurdle to the development of new mines worldwide.

Revex is Turning Waste into Value

Revex partners with mining companies to process and reclaim mine tailings (waste) to recover the remaining critical minerals, refine other valuable minerals, create new byproducts, and dispose of the remaining inert waste.

Recovering Minerals from Spent Lithium-Ion Batteries

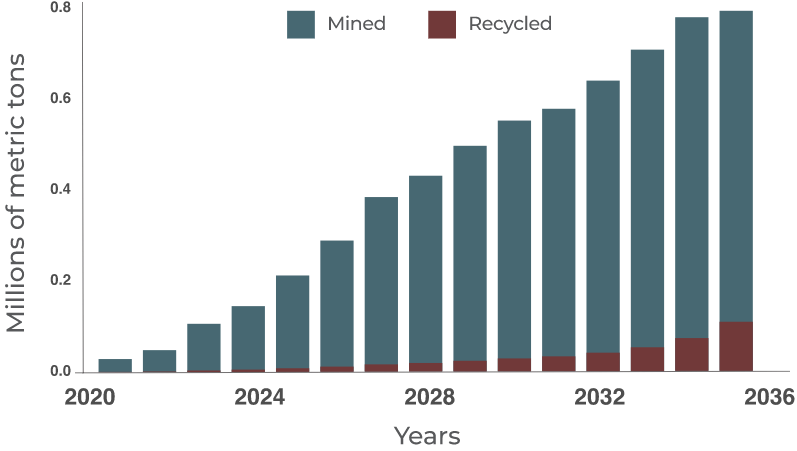

Recycling of Li-ion batteries is an important but only partial solution. Current recycling methods are limited by available battery supply and secondary use. The demand for battery materials will be slightly mitigated by increased recycling capability. By 2040, recycled batteries are expected to supply just 21% of cobalt, 12% of nickel, and 8% of lithium demand.

The Conclusion

For a strong & resilient Li-ion battery supply chain, we need an integrated solution

Revex is helping grow and integrate midstream processing and upstream extraction of nickel and other critical minerals through a multi-plant ecosystem. We are going even further by integrating battery materials recovery, mine waste reclamation, and creation of new byproducts. Revex complements gigafactory and other mid/downstream integration efforts currently underway between battery (cell/pack) manufacturers and EV OEMs.