Securing Domestic Supply Chains

Revex is the first scalable U.S. platform that builds the midstream processing needed to convert waste streams into U.S.-ready strategic minerals for defense, AI, aerospace, and energy resilience.

This is accomplished by reclaiming minerals from mine tailings and spent lithium-ion batteries, reducing permitting timelines, and lowering development, operational, and closure costs for tailings storage facilities. Our innovative solutions bolster U.S. supply chains, enhance sustainability, and support national security as reflected in the new NSS.

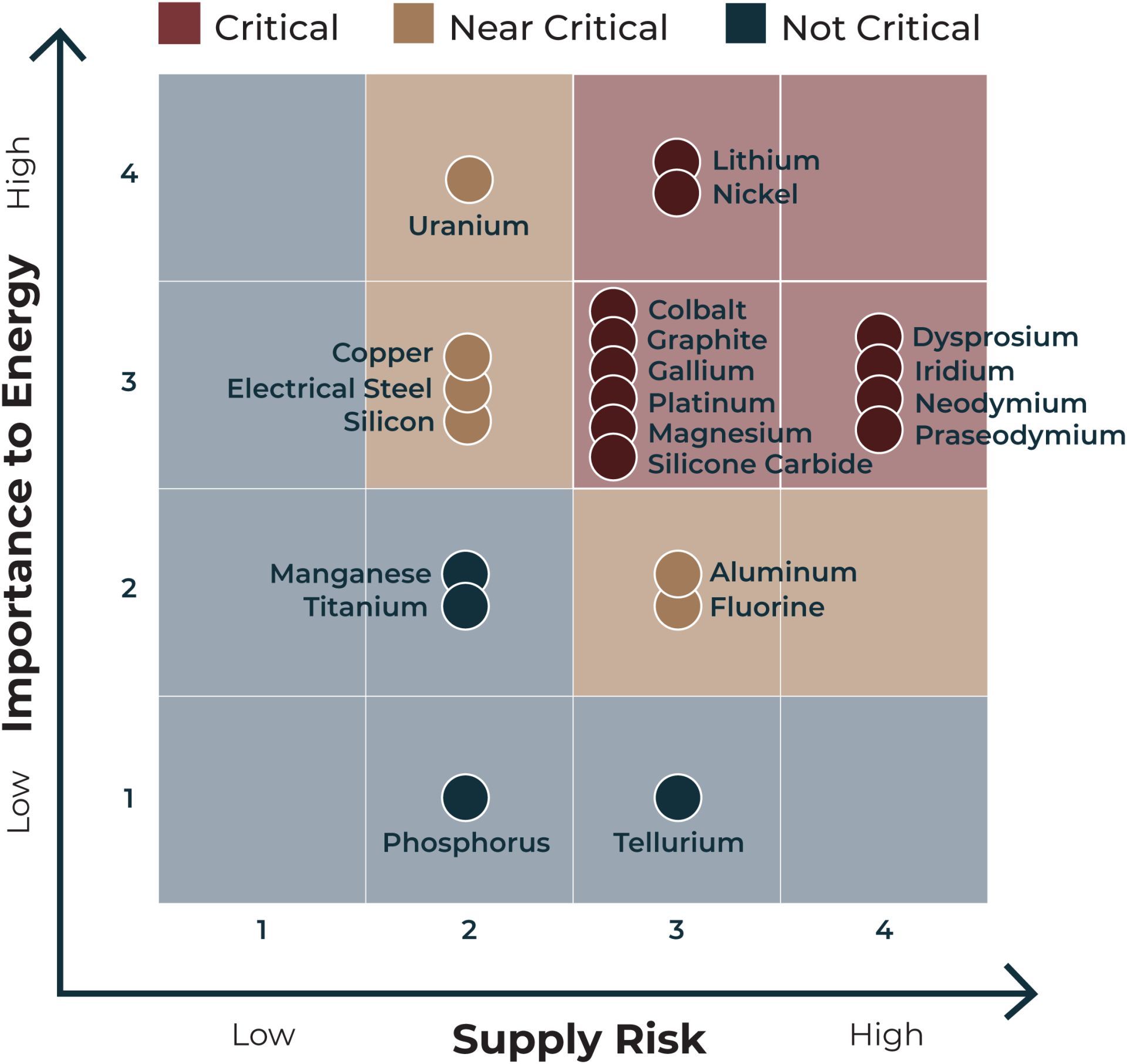

Domestic Mineral Shortfalls Face Rising Global Supply Risks

Reclamation of mining waste and recovery from secondary and unconventional sources are priority areas for U.S. critical mineral security. The focus for the White House is on:

- Building U.S. midstream processing capacity

- Reducing reliance on overseas midstream conversion

- Delivering consistent midstream-quality products to cathode/anode and material users

- Shortening lead times by reshoring midstream steps

- Expanding recycling from batteries and scrap

- Prioritizing nickel as a strategic mineral

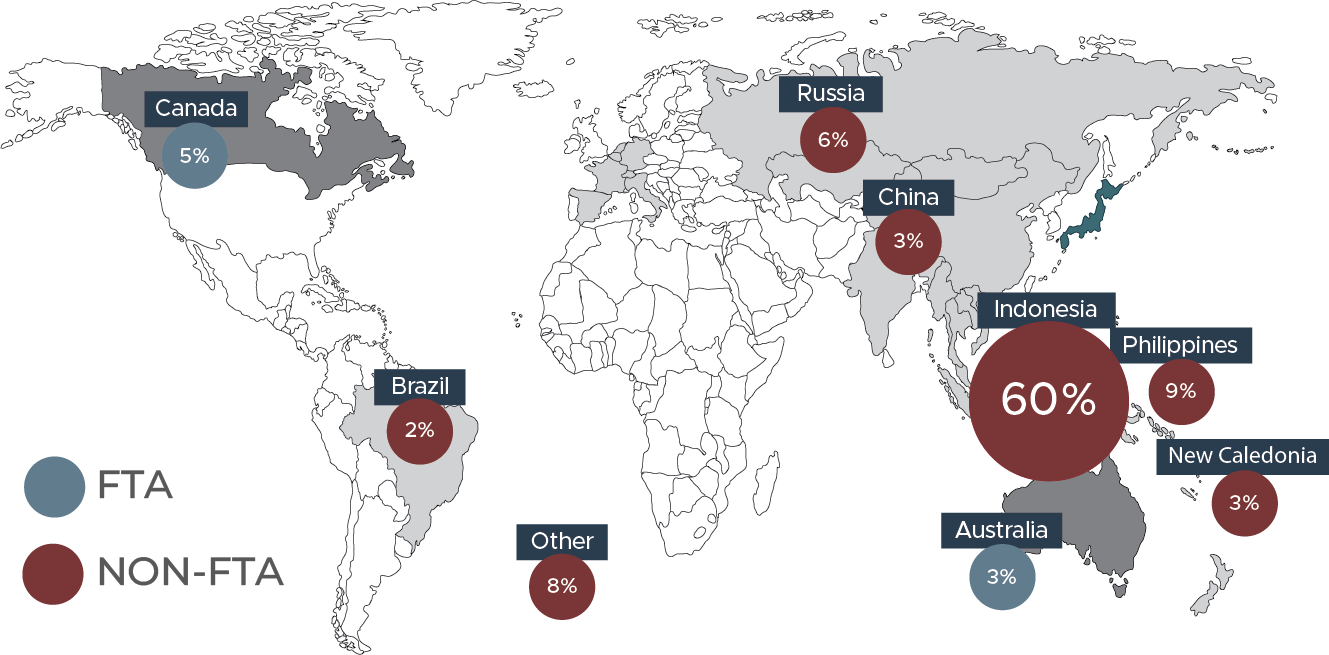

Where the US obtains critical minerals matters

Today, 47% of U.S. nickel imports come from countries without a U.S. Free Trade Agreement (FTA), including significant volumes from Russia. Under current project pipelines, analysts expect that about 92% of global primary nickel production in 2035 will be in non-FTA countries, meaning U.S. demand for clean-energy nickel will be increasingly exposed to geopolitically risky suppliers.

Recent federal trade policy now formally recognizes processed critical minerals and derivative products as a national-security category under Section 232, underscoring the importance of domestic processing capacity. Revex’s technology and domestic scale directly respond to that policy shift.

By stabilizing the policy and pricing environment for domestic processing, Section 232 materially improves the bankability of compliant midstream infrastructure such as Revex.

Indonesia’s nickel dominance

Indonesia, a non-FTA country, is now the dominant global nickel producer, supplying about 60% of the world’s nickel mine output in 2024. Chinese companies control around 75% of Indonesia’s nickel refining capacity, giving them outsized influence over the global battery-grade nickel supply chain.

Circle size and numbers show nickel min products in 2024 (thousand metric tons, nickel content).

Data: USGS Mineral Commodity Summaries 2025 – Nickel.

Nickel production as percent of global production in 2024, colored by Free Trade Agreement membership status. Data sourced from USGS Mineral Commodity Summaries 2025.

Nickel, in particular, is a security concern

Despite nickel’s importance for batteries and advanced alloys, the U.S. has only one operating nickel mine – Eagle Mine in Michigan – producing about 8,000 tons in 2024, or just 0.2% of global mine output. By contrast, Indonesia alone produced about 2.2 million tons – nearly 60% of world mine production – in 2024. This concentration of supply, mostly in non-FTA countries, heightens U.S. supply and national-security risks.

Advancing National Security with Sustainable Mineral Supply

Revex delivers a rapid supply of nickel, cobalt, and other minerals to meet U.S. energy demands for grid storage, data centers, and AI leadership. Our solutions enhance national security by providing minerals for defense applications. By leveraging proven technology and partnerships, such as the REV Nickel Project backed by $145M from the U.S. Department of Energy, Revex drives sustainable, low-CO2 mineral production to secure America’s future.

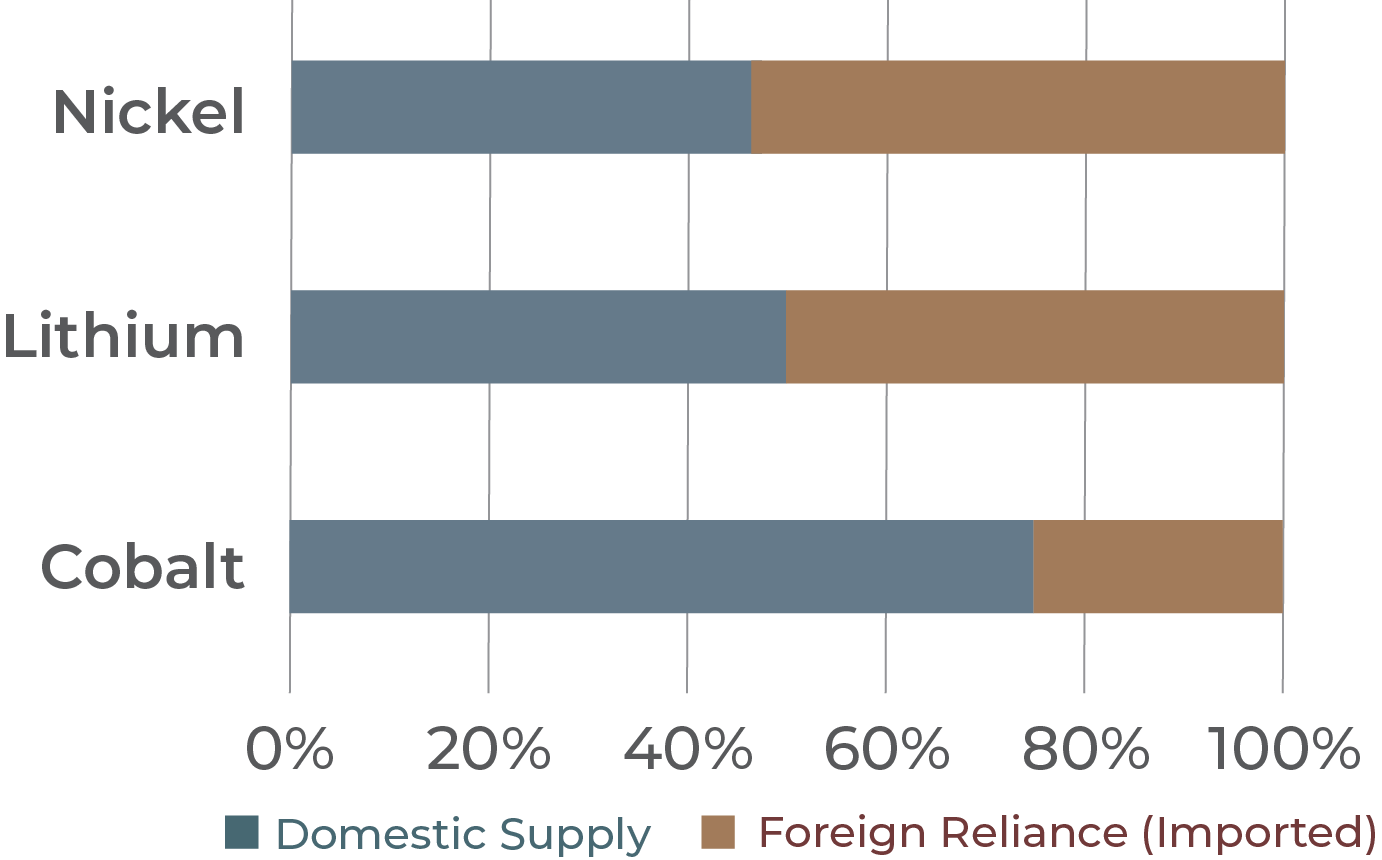

The Result

The U.S. is reliant on foreign import from our domestic supply of nickel (48%), cobalt (76%), and lithium (over 50%)

The US has critical mineral reserves and exploration to identify new reserves

The US has small identified nickel reserves (310,000 tons), substantial lithium reserves (1,800,000 tons), and the 10th highest global cobalt reserves (70,000 tons)

There is limited domestic mining

The US has one nickel mine (Michigan), one lithium mine (Nevada), and no cobalt mines

There is minimal processing capability

The US has no nickel or cobalt refineries and limited lithium processing capability

Reshoring & Policy Recognition of Processing as Critical Infrastructure

Mining expansion alone won’t solve the U.S. challenge to become competitive with China on critical minerals during the energy transition. Instead, industry and policy experts increasingly agree that “the key problem the current administration must swiftly address is the dearth of U.S. mineral processing plants and refineries.” In January 2026, federal policy formally recognized processed critical minerals and their derivative products as a national security category under Section 232. This reinforces the strategic need for domestic processing capacity — a key market gap Revex is designed to fill.

To establish our position as the leading producer and processor of non-fuel minerals, including rare earth minerals, which will create jobs and prosperity at home, strengthen supply chains for the United States and its allies, and reduce the global influence of malign and adversarial states.

Recovering Nickel & Cobalt from Unconventional Sources

Reclamation of Mining Waste

Standard processing of mine rock in both Nickel and Cobalt mines leave behind minerals that cannot be recovered from current standard mine ore processing techniques. Reclaiming and processing this remaining mineral content is a designated priority for the current White House Administration, Department of Interior, and Department of Energy. Mine tailings waste resulting from many mining processes can be acid-generating and challenging to dispose of appropriately. The permitting and costs associated with mine tailings is a hurdle to the development of new mines worldwide.

Revex is Turning Waste into Value

Revex partners with mining companies to process and reclaim mine tailings (waste) to recover the remaining critical minerals, refine other valuable minerals, create new byproducts, and dispose of the remaining inert waste

Our Commitment

Revex Technologies integrates upstream extraction, midstream processing, and downstream recycling to deliver low-CO2, sustainable mineral solutions. We streamline project timelines, reduce costs for mines, minimize environmental risks, and strengthen the resiliency of U.S. supply chains. Our work strengthens not only economic and environmental resilience, but also U.S. defense industrial base security by enabling FEOC-free, auditable critical mineral supply through modular, repeatable processing facilities designed for replication across U.S. and allied mining regions.

Learn more about critical minerals at

www.energy.gov